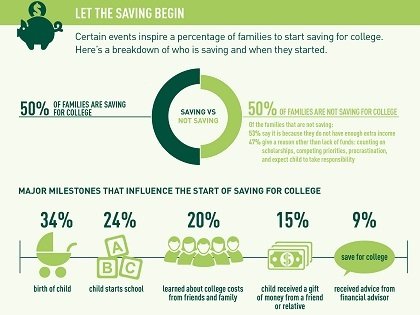

STATEPOINT — Despite rising college costs, fewer American families with children under age 18 are saving for college. Only 50 percent are doing so today, compared to 60 percent just two years ago, according to “How America Saves for College 2013” a national study from Sallie Mae, the country’s largest financial services company specializing in education.

While nearly all parents believe college is an investment in their children’s future, only one-third have plans to pay for college. And when asked to describe their feelings about saving for college, parents’ top answers were overwhelmed, annoyed, frustrated, scared, or that they don’t like thinking about it at all.

Among those not saving, 47 percent cite barriers other than money. Top reasons included thinking children would be awarded enough financial aid to cover college costs, uncertainty about which savings option to use, and other concerns.

Slightly more than one quarter of parents who are saving for college use a 529 college savings plan, a tax-advantaged program created to help families save for education expenses. However, more parents save for college using general funds or CDs, and therefore may miss out on tax incentives offered by 529 accounts.

More information about saving for college is available online at www.salliemae.com/howamericasaves.