The African-American community of Baltimore has a proud tradition of making progress in the face of changing and challenging situations. This community contributed greatly to the renowned shipbuilding, steel, auto and textile industries on which the area thrived. Generations of determined people helped nurture icons like Thurgood Marshall, the first African-American Supreme Court justice; Frederick Douglass, the prominent abolitionist and statesman; and Billie Holiday, the famed jazz musician.

During Black History Month, we celebrate the survival and achievements of African-Americans while never losing sight of the ongoing efforts to achieve social justice and economic equality. In a world where wealth disparities continue to exist, we need to help improve the lives of those around us. And one of the steps in this process is ensuring equal access to financial services and technology.

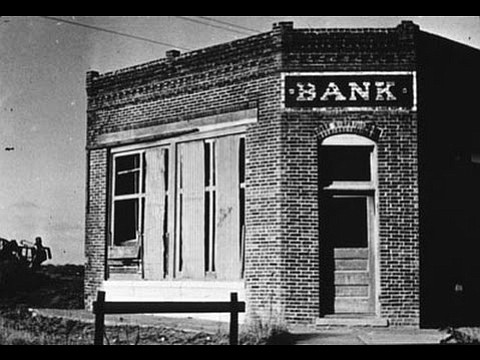

Here in the Baltimore area, nearly 6 percent of families are unbanked and more than 21 percent are under-banked, according to the Federal Deposit Insurance Corporation (FDIC). Collectively considered “financially underserved,” these families have no or only limited access to traditional financial services, such as a bank account. Instead, they often use check cashers, payday lenders and money orders to conduct even their most basic financial transactions— from cashing a paycheck to paying their electric bill. The FDIC also found that unbanked and underbanked rates were higher among minority households.

In 2015, only 32 percent of consumer transactions were completed using cash, showing the growing trend toward other forms of payment such as debit, credit and prepaid cards. While not a panacea for closing the vast wealth gap between the races, today’s electronic payment technology can help family’s access and use their money in a more convenient, efficient and less costly way. For instance, payroll cards allow workers to receive their wages directly on their card, much like banked workers have their paycheck deposited directly into a bank account.

This eliminates the time and money workers would otherwise spend to collect their paper paycheck and cash it at a check-cashing center. Workers can pay bills instantly online and use electronic and mobile tools to make a budget and track their spending. Payroll cards have the added benefit of saving money for employers of all sizes by allowing them to eliminate the cost of cutting paper checks.

As cards and other forms of electronic payment technology come into greater use,there is both the need and the opportunity to engage in efforts to help improve the financial health of the community by making the best use of what we have. That’s one of the reasons why I am a member of the African American Advisory Board for Master Your Card, a community empowerment program.

Let me explain why this education is so important. While the average person knows how to use their debit card at the register to pay for groceries, we find that many first-time card users assume they have to go to an ATM each time they have a transaction to make. Through Master Your Card, we teach financially underserved individuals how to use this technology to access their money in a convenient and secure way. For instance, I worked with the program and the A. Philip Randolph Institute to facilitate the development of a toolkit that provides young adults and seniors with information and tips on how they can join the digital economy and achieve greater financial security.

The African-American community has a rich history of coming together to make great strides and help to propel our country forward. By rising to the challenges facing

the financially underserved and using the right tools, we can empower each other to achieve greater financial access and equality.

Fred Mason is president of the Maryland and District of Columbia AFL-CIO and a member of the Master Your Card African American Advisory Board.