Nationwide (BlackNews.com) — By now, most people have either forgotten about or given up on their New Year’s resolutions but author and Money Breakthrough Coach Monique Caradine says it’s not too late to make good on your resolution to do better with money. By becoming aware of these four common but rarely talked about mistakes, you can eliminate debt, increase your cash flow, add to your savings and finally end the money struggle starting this year.

Mistake #1 – Not dealing with your inner money story. Many women believe that working more hours or gaining more clients will solve their money problems. Not so says Caradine. “If you really want to start manifesting more money with ease, you must first change the way you think about money, how you talk about money and what you believe about money.” She says it is a mistake to believe that a bonus check, raise, inheritance, lottery jackpot or dream job will end your money struggle long-term. It’s the “inner money story” that needs to be fixed first.

Mistake #2 – Not having a clear vision of the wealth you want to create. “This is one of the biggest mistakes I see women make,” says Caradine. “Too often, we as women simply accept the inadequate pay that comes from our job or business because we feel we don’t have control over what we can make.” Caradine said. “By having a clear vision of how much money it will take to live your desired lifestyle, you can not only manifest more, you can also make a plan to eliminate debt and establish a legacy of wealth for your children starting with what you have right now,”she added.

Mistake #3 – Comparing yourself to others. “The moment we stop trolling celebrity social media feeds to see what they’re wearing or driving is the moment we can begin to make an immediate shift in our own money situation,” Caradine says. “Comparing ourselves to the Kardashians for instance, has a major sub-conscious effect. It can cause you to give in to the temptation to spend hard-earned money on clothes, handbags, cars and other things that hold no long-term value.”

Mistake #4 – Having only one source of income. “Without exception, every woman should have at least two sources of income, period.” Says Caradine. She believes in today’s economy, having more than one income stream helps to ensure your financial stability and it protects you from unexpected changes in the job market and uncertainty in the economy.

So how do we stop repeating these mistakes and get on the path to abundance? Caradine says one thing we can do right now is recognize that creating a 6- or 7-figure income is a spiritual journey that starts on the inside first. “I believe that most women have the potential to be rich, but until we begin to truly understand both the spiritual and practical secrets about how money works, the struggle for more of it will continue.”

In her new book How to Embrace Your Inner Millionaire, Caradine lays out eight simple steps women can take right now to get on the path to abundance. A free excerpt of the book is available now at www.myinnermillionaire.com.

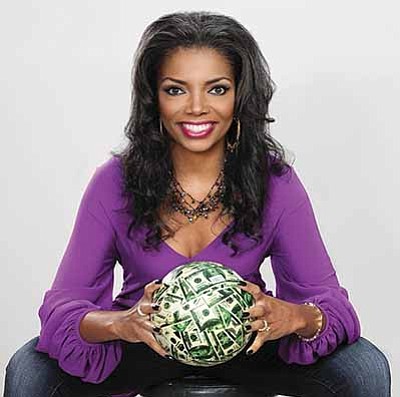

About Monique Cardine:

A former radio and TV personality, Monique Caradine-Kitchens is now known as the OverFlow Coach. She helps women fix their relationship with money so they can stop worrying about it, stressing over it, and chasing after it and instead, start manifesting more than enough of it. After having money drama of her own for many years, Monique re-wrote her money story so she could finally embrace her inner millionaire. She is now a certified coach who helps women around the world do the same.