Maryland Mortgage Program offers special interest rate for homes purchased in Maryland’s Targeted Areas

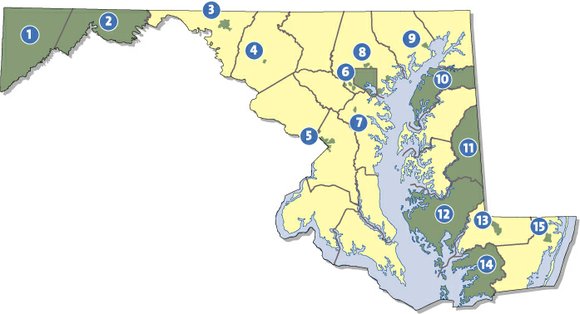

Areas shaded green represent Targeted Areas.

For larger view visit website- http://www.mmprogram.org/documents/target_areas.htm

Crownsville, Maryland— The Maryland Department of Housing and Community Development (DHCD) announced that the Maryland Mortgage Program is offering reduced interest rates in Targeted Areas around the state.

In recognition of June as National Homeownership Month, the program was announced by Division of Development Finance Deputy Director William Ariano at a free educational event co-sponsored by the Maryland Mortgage Bankers Association at Scossa Restaurant and Lounge in Easton (Talbot County). Deputy Director Ariano also provided a message from DHCD Secretary Raymond A. Skinner celebrating National Homeownership Month

“Governor O’Malley and Lt. Governor Brown believe that there is no place in our state as important as the family home,” said Secretary Skinner. “Housing values are improving. Interest rates remain low. National Homeownership Month is a perfect time to explore your homebuying options, including the Maryland Mortgage Program.”

The Maryland Mortgage Program offers a variety of low-interest, fixed-rate mortgage loan options with down payment and closing cost assistance for first-time homebuyers. Purchasers in a Targeted Area are eligible for a one-time exemption to the first-time homebuyer requirement. The interest rates for the Targeted Areas Program will be half of a percent below the regular program rates. Current rates will be updated and published daily on the Maryland Mortgage Program website – http://www.mmprogram.org. Targeted Areas in Maryland include the entire jurisdictions of Allegany, Caroline, Dorchester, Garrett, Kent, and Somerset Counties, as well as Baltimore City. Additionally, portions of other counties throughout Maryland are designated as Targeted Areas.

As with all Maryland Mortgage Program loans, participating homebuyers are eligible for up to $5,000 in down payment and closing cost assistance through the Down payment and Settlement Expense Loan Program (DSELP). DSELP assistance can be combined with other Maryland Mortgage Program partner match programs like House Keys 4 Employees and the Builder/Developer Incentive Program.

The Maryland Mortgage Program also offers other homeownership initiatives like the Maryland Homefront Program, designed for veterans and military families (with special downpayment incentives). In addition, there is a special mortgage loan product that includes incentives for eligible buyers of any non-DHCD-owned, foreclosed or short sale property (collectively referred to as the Save-a-Home Loan Program) in a non-targeted area, including $6,500 in DSELP assistance. Other special offers on foreclosed properties owned by DHCD are available through the Department’s Real Estate Owned Program and First Look Maryland.

Maryland’s flagship mortgage purchase program has been under the purview of the Department’s Community Development Administration for more than 30 years. Program loans are administered by a network of approximately 48 private lending institutions across the state.

For more information on the Maryland Mortgage Program, especially details on income and purchase price limits and a map of targeted areas, please visit www.mmprogram.org or contact the Community Development Administration by phone at 410-514-7535 or by e-mail at SingleFamilyHousing@mdhousing.org.